Bipartisan Bills to Protect Children, Cut Red Tape

FOR IMMEDIATE RELEASE

February 27, 2024 Contact: [email protected]

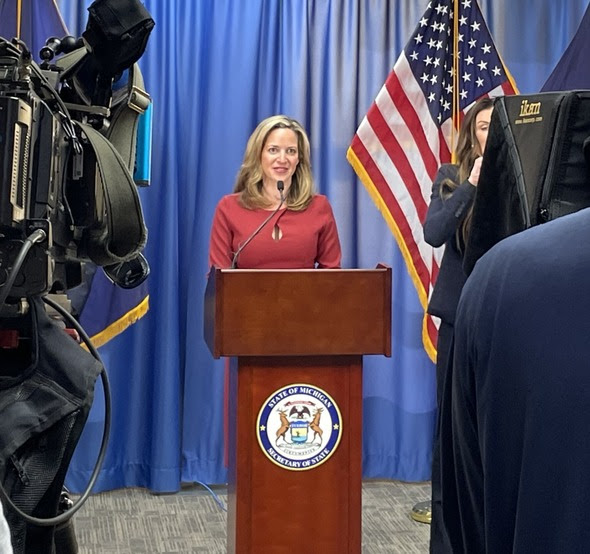

Gov. Whitmer Signs Bipartisan Bills to Protect Children, Cut Red Tape, Improve Environmental Review Process

LANSING, Mich.— Today, Governor Whitmer signed two bipartisan bills to better protect foster care children in Michigan and ensure they are receiving a high-quality education. She also signed a trio of bills to cut red tape and improve the environmental rules promulgation process.

“Today’s commonsense, bipartisan bills will help us better protect young Michiganders and cut red tape,” said Governor Whitmer. “We must ensure that our kids have the support they need and monitor the effectiveness of our child care programs. Also, let’s continue streamlining permitting by cutting out duplicative steps without compromising community voices. Together, we can make state government work better for Michiganders and keep delivering tangible results that make a real difference in people’s lives.”

Child Care Facilities House Bill 4677, sponsored by state Representative Stephanie Young (D-Detroit), requires the Department of Health and Human Services (DHHS), the Department of Education (MDE), and the Center for Educational Performance and Information to provide an annual report to the Legislature that contains information on foster children in the education system.

“It is a great day for foster youth all across our state. I was proud to sponsor House Bill 4677, which requires more detailed and regular assessments and tracking of youth in care,” said state Representative Stephanie Young (D-Detroit). “This bill also requires an annual report back to the House and Senate standing committees and appropriations subcommittees for the DHHS budget. Everyone who’s making decisions about these young people are about to get on the same page with better information to help guide our decision-making. I want foster youth to know we are committed to putting them first and to making their lives better, providing them the resources they need for success; we see them and we hear them.”

House Bill 4678, sponsored by state Representative Kimberly Edwards (D-Eastpointe), requires the MDE to regularly review educational programs provided in child caring institutions to ensure compliance with the Revised School Code and rules promulgated under the Code.

“My years as a child welfare specialist exposed me to the challenges many foster youth face in and out of the classroom. There are all too many stories from foster youth who persevered on classwork through unstable situations and found out too late that classes they took didn’t count toward a diploma. These students’ educational triumphs should not be stunted as a result of a broken system,” said state Representative Kimberly Edwards (D-Eastpointe). “This package to require regular review and assessment of the educational programs provided in child caring institutions is crucial to ensure every student in foster care is set up for success. We must continue putting children first — and that means all children.”

Cutting Red Tape House Bills 4824, 4825, and 4826 remove authority from the Environmental Rules Review Committee (ERRC), an inefficient, duplicative link in the environmental rules review chain. EGLE’s robust stakeholder input process for rule-making already brings in diverse expertise related to the issues before the department. A more streamlined rule-making process that ensures EGLE can move forward utilizing sound science would better protect public health and the environment while helping the state be more efficient.

“My bill is about making the government more efficient and cutting the unnecessary entities that hinder the delivery of good, fair and timely services,” said state Representative Donavan McKinney (D-Detroit). “The dissolution of the Environmental Rules Review Committee is the right thing to do for the future of protecting our environment and for the commitment we’ve made to putting people first. Over the years, we’ve seen countless examples of the committee becoming an overbearing obstacle in the process of the Department of Environment, Great Lakes, and Energy. This legislation removes this barrier and paves the way for us to meet the cleaner, renewable energy the people of Michigan want and deserve.”

“By eliminating this panel, we’re allowing EGLE to more effectively do its critical job,” said state Representative Jenn Hill (D-Marquette). “This streamlined approach ensures quicker responses to environmental challenges, safeguarding public health and our state’s precious natural resources.”

“I’ve always been an advocate for protecting our environment. By removing the Environmental Rules Review Committee — a committee mostly made up of corporate polluters — from statute, we are able to ensure that the Michigan Department of Environment, Great Lakes, and Energy can fulfill its mission of protecting our air, water, land and people,” said state Representative Sharon MacDonell (D-Troy). “I’m glad to see this bill make its way to the finish line. We are putting the health and well-being of Michiganders before corporate profit.”

Governor Whitmer’s Permitting Executive Directives In April 2023, Governor Whitmer signed an executive directive to bring an all-hands-on-deck approach to ensuring state government is responsive, efficient, and effective in responding to permit applicants and getting projects done on time while protecting our environment, maintaining rigorous standards of permit review, and putting science and Michiganders first.

It directed state departments and agencies to assess what permits and licenses they issue and the statutory authorities governing

The full executive directive can be found here.

In June 2022, Governor Whitmer signed another executive directive on permitting, summarized here:

Click to view the full PDF of the executive directive. |