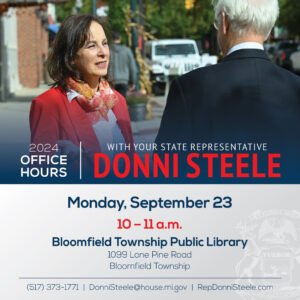

State Representative Donni Steele Office Hours

Donnie Steele Office Hours

Monday, September 23

10 – 11 a.m.

Bloomfield Township Public Library

1099 Lone Pine Road

Bloomfield Township

(517) 373-1771 | DonniSteele@house.mi.gov | RepDonniSteele.com

FOR IMMEDIATE RELEASE September 10, 2024 Contact: press@michigan.gov

Governor Whitmer Makes Appointments to Boards and Commissions

LANSING, Mich. — Today, Governor Gretchen Whitmer announced the following appointments to the State Teacher Tenure Commission, Michigan Board of Speech Language Pathology, Michigan Board of Athletic Trainers, Michigan Board of Real Estate Appraisers, Michigan Board of Real Estate Brokers and Salespersons, Michigan Board of Podiatric Medicine and Surgery, State Building Authority Board of Directors, Michigan Gaming Control Board, Michigan Citizen-Community Emergency Response Coordinating Council, and Unemployment Insurance Appeals Commission.

Today’s appointees represent Michigan’s young professionals, communities of color, seniors, and more. The appointees announced this week build on Governor Whitmer’s work to ensure appointees reflect Michigan’s diverse population. Sixty percent of appointees are women or people of color, and the Whitmer cabinet is the most diverse in Michigan history.

State Teacher Tenure Commission Kevin Polston, of Grand Haven, has served as superintendent of Kentwood Public Schools since 2021. His previous superintendent experience included four years at Godfrey-Lee Public Schools in Wyoming. Prior to becoming a superintendent, he served as a teacher, coach, principal, and curriculum leader at Grand Haven Area Public Schools for 15 years. Polston had previously been appointed to the Return to School Advisory Council and the Student Recovery Advisory Council. Polston holds a Bachelor of Arts in education from Michigan State University, a master’s in educational leadership from Grand Valley State University, and he is currently a doctoral candidate studying educational leadership at Central Michigan University. Kevin Polston is appointed to represent a superintendent of schools for a term commencing September 10, 2024, and expiring August 31, 2028. Polston succeeds Andrea Tuttle, who has resigned.

The State Teacher Tenure Commission acts as a board of review for all cases appealed from the decision of a controlling board involving decisions on teacher tenure matters. Cases are first handled by an internal MDE body and may be appealed to the State Teacher Tenure Commission.

This appointment is not subject to the advice and consent of the Senate.

Michigan Board of Speech Language Pathology Ahlam Issa, of Ann Arbor, is the founder and owner of Issa Speech Therapy. She earned her Bachelor of Science and master’s in communication sciences and disorders from Eastern Michigan University. Issa has also earned a license as a Speech-Language Pathologist and a certificate from the American Speech-Language-Hearing Association. Ahlam Issa is appointed to represent speech language pathologists for a term commencing September 10, 2024, and expiring December 31, 2027. Ahlam Issa succeeds Michael Dunn whose term has expired.

The Michigan Board of Speech Language Pathology works with the Department of Licensing and Regulatory Affairs to oversee the practice of speech pathologists in this state. The Public Health Code defines the practice of speech-language pathology as the application of principles, methods, and procedures related to the development of disorders of human communication. Underlying all duties is the responsibility of the board to promote and protect the public’s health, safety, and welfare.

This appointment is not subject to the advice and consent of the Senate.

Michigan Board of Athletic Trainers Darryl Conway, of Dundee, is the senior associate athletic director and chief health and welfare officer for the University of Michigan. He holds a Master of Arts in Physical Education from Adelphi University. Conway is reappointed to represent athletic trainers for a term commencing September 10, 2024, and expiring June 30, 2028.

The Michigan Board of Athletic Trainers works with the Department of Licensing and Regulatory Affairs to oversee the practice of approximately 1,028 athletic trainers. The practice of athletic training, as defined in the Public Health Code, means the treatment of an individual for risk management and injury prevention, the clinical evaluation and assessment of an individual for an injury or illness, the immediate care and treatment of an individual for an injury or illness, and the rehabilitation and reconditioning of an individual’s injury or illness.

This appointment is subject to the advice and consent of the Senate.

Michigan Board of Real Estate Appraisers Dr. Jumana Judeh, of Livonia, is the president of Judeh & Associates. She earned her Bachelor of Science in management from Purdue University and her master’s in industrial relations and a doctorate in sustainable urban redevelopment from Wayne State University. Dr. Judeh also holds a certificate as a certified general appraiser. Dr. Jumana Judeh is reappointed to represent certified real estate appraisers for a term commencing September 10, 2024, and expiring June 30, 2028.

The Michigan Board of Real Estate Appraisers works with the Department of Licensing and Regulatory Affairs to oversee the practice of approximately 6,011 limited real estate appraisers, state licensed appraisers, certified general appraisers, and certified residential appraisers.

This appointment is subject to the advice and consent of the Senate.

Michigan Board of Real Estate Brokers and Salespersons Aaron Fox, of Grand Ledge, is the Broker and Owner of Century 21 Affiliated in Lansing. He has previously worked as a broker and owner of Century 21 Looking Glass. Aaron holds both a real estate principal associate broker license and a real estate non-principal associate broker license. Aaron has received a State Certified Fair Housing Instructor Certification from Michigan Realtors, and a New Agent and Broker Eligibility from Holloway’s Real Estate Institue. Aaron Fox is appointed to represent real estate brokers and salespersons for a term commencing September 10, 2024, and expiring June 30, 2028. Fox succeeds Natalie Rowe, whose term has expired.

Maggie LaHaie, of Cheboygan, is the owner of Legend Bookkeeping. LaHaie earned an Associate of Arts from Grand Rapids Community College. She also earned a Bachelor of Business Administration in economics and international business from Grand Valley State University and a Bachelor of Science in international economics from the Krakow University of Economics. Mrs. LaHaie is reappointed to represent the general public for a term commencing September 10, 2024, and expiring June 30, 2028.

The Michigan Board of Real Estate Brokers and Salespersons oversees the practice of real estate salespersons, associate real estate brokers, real estate brokers, and branch offices.

These appointments are subject to the advice and consent of the Senate.

Michigan Board of Podiatric Medicine and Surgery Andrea Ciaravino, of Bloomfield Hills, is a physician’s assistant and specializes in podiatric medicine, sports medicine, and orthopedics. She earned a Bachelor of Science in Kinesiology from Michigan State University and a Master of Science in Physician Assistant Studies from the University of Detroit Mercy. She currently works in the Henry Ford Health System. Ciaravino is reappointed to represent physicians’ assistants for a term commencing September 10, 2024, and expiring June 30, 2027.

The Michigan Board of Podiatric Medicine and Surgery was formed to license and regulate the practice of podiatric medicine and surgery, which is defined in the Public Health Code as the evaluation, diagnosis, management, and prevention of conditions of the lower extremities, including local manifestations of systemic disease in the human foot and ankle, by attending to and advising patients and through the use of devices, diagnostic tests, drugs and biologicals, surgical procedures, or other means.

This appointment is subject to the advice and consent of the Senate.

State Building Authority Board of Directors Michael Barnwell, of Ira, is the president of the Michigan Regional Council of Carpenters and Millwrights. Barnwell trained at the Millwright Institute of Technology in Warren and is a journeyman millwright and 30-year member of the MRCC. He currently serves as co-chair of the Michigan State Building Authority Board of Directors. Michael Barnwell is reappointed to represent the general public for a term commencing September 10, 2024, and expiring August 21, 2028.

The State Building Authority was created to acquire, construct, furnish, equip, and renovate buildings and equipment for the use of the state, including public universities and community colleges. The Authority is authorized to issue and sell bonds and notes for acquisition and construction of facilities and state equipment.

This appointment is subject to the advice and consent of the Senate.

Michigan Gaming Control Board Mark Evenson, of South Lyon, is the chief financial officer at Diversified Members Credit Union. Evenson received a bachelor’s degree in management from Eastern Michigan University, and a master’s degree in corporate finance from Walsh College. He previously served on the board of directors of the Plymouth Chamber of Commerce and as vice chair of the board of the Novi Educational Foundation. Mark Evenson is appointed to represent Republicans for a term commencing September 10, 2024, and expiring December 31, 2026. He succeeds Robert Anthony, who has resigned.

The Michigan Gaming Control Board shall ensure the conduct of fair and honest gaming to protect the interests of the citizens of the state of Michigan. The Board provides Detroit commercial casinos gaming operations licensing and regulation, licenses and regulates online gaming and sports betting operators, platform providers and suppliers, regulates pari-mutuel horse racing and casino-style charitable gaming, and audits tribal gaming compact agreement compliance.

This appointment is subject to the advice and consent of the Senate.

Michigan Citizen-Community Emergency Response Coordinating Council Cody Dorland, of Clare, is an emergency services technician with Dow Chemical, a lieutenant at the Coleman Community Fire Department, and the Midland County Fire Training Coordinator. Dorland holds an Emergency Management certificate from the Michigan State Police, a Fire Inspector I certification from the Michigan Bureau of Fire Services and holds numerous other certificates in emergency management. Cody Dorland is appointed to represent individuals with technical expertise related to emergency response for a term commencing September 10, 2024, and expiring December 31, 2026. He succeeds Aimee Barajas, who has resigned.

The MCCERCC assists in developing, maintaining, implementing and supporting and promoting emergency response principles, strategies, and practices within governmental agencies and private sector organizations in Michigan.

This appointment is not subject to the advice and consent of the Senate.

Unemployment Insurance Appeals Commission William Runco, of Dearborn, has been serving on the Unemployment Insurance Appeals Commission since 2019. Previously, he served as 19th District Court Chief Judge and a Michigan State Representative for the 31st District. He holds a Bachelor of Arts in Economics and a Juris Doctorate from the University of Michigan. William Runco is reappointed to serve on the Unemployment Insurance Appeals Commission as an attorney licensed to practice in Michigan courts for five years or more for a term commencing September 10, 2024, and expiring July 31, 2028.

The Unemployment Insurance Appeals Commission serves Michigan’s employees, employers, and insurers by addressing and impartially resolving appeals of decisions and orders involving workers’ compensation and unemployment insurance benefits. The Commission created in Executive Order No. 2019-13 has full authority to handle, process, and decide appeals filed under Michigan Employment Security Act Section 33(2).

This appointment is subject to the advice and consent of the Senate. |

FOR IMMEDIATE RELEASE September 10, 2024 Contact: press@michigan.gov

Gov. Whitmer Lowers Flags to Honor Patriot Day

LANSING, Mich. – Governor Gretchen Whitmer has ordered U.S. and Michigan flags across the state to be lowered to half-staff on Wednesday, September 11, 2024 to honor and remember the heroes who lost their lives and those who sacrificed their lives for others, including first responders who showed bravery in responding to the attacks and aiding the victims.

“On Patriot Day, we remember those we lost in the terrorist attacks on 9/11, honor those who serve, and recommit ourselves to standing up for our values,” said Governor Whitmer. “I encourage all Michiganders to come together in a moment of silence at 8:46 a.m. local time and participate in local community service or charitable giving. This day reminds us to cherish the fundamental, American values we all love—freedom and opportunity—and offers us an opportunity to build a brighter future where we stand together.”

“On Patriot Day, we come together as Michiganders to honor and remember the first responders, service members, and everyday Americans who stepped up for their fellow citizens on 9/11,” said Lt. Governor Garlin Gilchrist II. “They cared for the wounded, ran towards danger, and in many cases made the ultimate sacrifice. Today, let us take time to reflect on their courage and commitment and rededicate ourselves to honoring their memory.”

The State of Michigan remembers and honors the heroes who lost their lives and those who sacrificed their lives for others by lowering flags to half-staff. Michigan residents, businesses, schools, local governments, and other organizations also are encouraged to display the flag at half-staff.

To lower flags to half-staff, flags should be hoisted first to the peak for an instant and then lowered to the half-staff position. The process is reversed before the flag is lowered for the day.

Flags should be returned to full staff on September 12, 2024.

|

|

|||

|

|

|||

| Hi there,

Today is World Suicide Prevention Day and September is National Suicide Prevention Month, so I wanted to share a reminder to check in on your friends, family, and neighbors. It’s important that we all take steps to make sure our loved ones are doing OK, especially if they are a member of a high-risk group like veterans who bravely served our country. And if you’re struggling or know someone who is, you can call or text the Suicide & Crisis Lifeline at 988 for free, 24/7 support. The Substance Abuse and Mental Health Services Administration provides a variety of helpful resources and programs, which you can learn more about here. – Rep. Elissa Slotkin |

|

|

|

Written Friday September 6th at 11:55 PM

UPDATED TOP TEN

WEEK TWO SCORES

Dearborn Divine Child 42, BLOOMFIELD HILLS 0.

FARMINGTON 33, Holly 7.

TROY 35, PONTIAC 0.

SEAHOLM 21, AVONDALE 7.

TROY ATHENS 20, BERKLEY 0.

FERNDALE 20, NORTH FARMINGTON 12.

OAK PARK 19 ROYAL OAK 7.

OXFORD 38, HARPER WOODS 0.

CLARKSTON 48, SOUTHFIELD ARTS AND TECH 0.

ADAMS 28, ROCHESTER 0.

GROVES 28, WEST BLOOMFIELD 13.

LAKE ORION 42, STONEY CREEK 13.

WIN OF THE WEEK: Oxford: The Wildcats pulled off one of the biggest shockers in the State by beating the defending Division Four State Champions Harper Woods 38-0 on Friday night. Oxford had a strong game plan for the Pioneers high octane offense and the Wildcats offense had a field day against a really good defense. This is a huge win for Oxford especially with Clarkston looming next week.

WHAT IN THE BLUE WORLD: North Farmington: The Raiders are in a ton of trouble after falling 20-12 to Ferndale on Friday night. North Farmington is in must win mode after having another tough loss. They have Farmington looming in the Farmington Cup next week.

TEAM THAT NEEDS A HUG: West Bloomfield: The Lakers had a rough start on Friday night in Beverly Hills falling 28-13 to Groves. West Bloomfield couldn’t stop the run early trailing 14-0 but they found some momentum but the Falcons got it back and ended up winning. The Lakers have Adams looming next week.

ARE YOU KIDDING ME: Bloomfield Hills: The Blackhawks are really struggling falling 42-0 to Dearborn Divine Child on Friday night falling to 0-2 on the season. Bloomfield Hills needs to bounce back in the worst way possible next week and they have Seaholm looming.